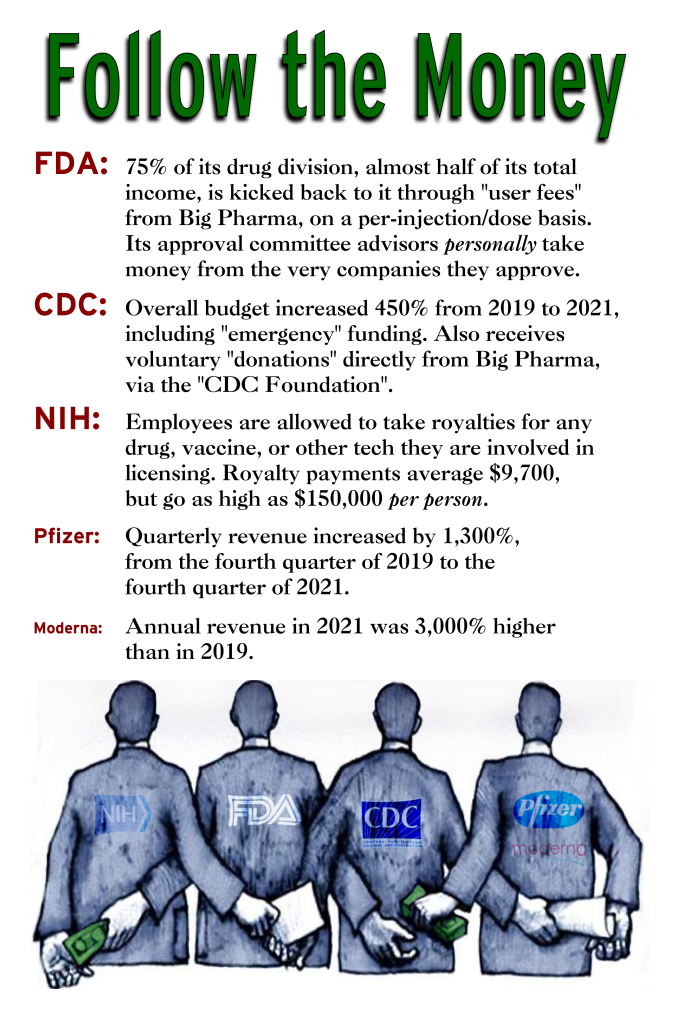

Follow the Money — Pharma and Cronies

- FDA:

- https://www.nytimes.com/2022/09/15/health/fda-drug-industry-fees.html

- https://www.fda.gov/about-fda/fda-basics/fact-sheet-fda-glance

- https://www.science.org/content/article/hidden-conflicts-pharma-payments-fda-advisers-after-drug-approvals-spark-ethical

- https://ethics.harvard.edu/blog/risky-drugs-why-fda-cannot-be-trusted

- https://www.pbs.org/wgbh/pages/frontline/shows/prescription/hazard/independent.html

- https://readsludge.com/2022/01/06/bidens-big-pharma-pick-for-fda-could-squeak-through-with-help-from-pharma-funded-republicans/

- https://www.scientificamerican.com/article/how-the-fda-manipulates-the-media/

- CDC

- https://www.cdc.gov/funding/documents/fy2019/fy-2019-ofr-snapshot-508.pdf

- https://www.cdc.gov/funding/documents/fy2021/fy-2021-ofr-assistance-snapshot-508.pdf

- https://ashpublications.org/ashclinicalnews/news/4797/CDC-Pressed-to-Acknowledge-Industry-Funding

- https://www.tabletmag.com/sections/science/articles/how-the-cdc-abandoned-science

- NIH:

- Pfizer:

- Moderna

The Truth about Income Inequality

There has been a lot of hoopla, lately, about the gap between rich and poor, how it’s growing, and how we need to give government more power to get rid of that income disparity. It’s actually been shrinking for the past four years, but it’s still larger in the US than most countries.

Some people say that it’s proof capitalism doesn’t work and needs to be banned, or at least that we need more income redistribution. Otherwise, the masses may revolt, like they’re doing in Greece and eventually take everything, therefore the ruling class have to choose between being violently overthrown, or surrendering their wealth.

But this all begs the question of why we’re talking about income inequality in the first place. The real question is whether we should be talking about differences between people, or overall quality of life for everyone.

Should We Care about the Wealth Gap?

Which would be better:

- A society where the wealthiest earn a certain amount per year, and others earn about 50% that much.

- A society where the wealthiest earn a certain amount per year, and others earn only 5% of that much.

If you answered either way, you’ve blown a test of basic logic; You have no way of knowing which is better, unless you know how well the poor are doing in real-world terms.

For example, let’s say you answered that (1) is better, where the wealthy earn only twice as much as the poor, instead of twenty times as much.

But it turns out that, in the two examples:

- The wealthiest earn $20,000 per year, and the others $10,000

- The wealthiest earn $1,000,000 per year, and others earn $50,000

Would you REALLY prefer that the poor only get $10,000 per year, instead of $50,000 (in dollars with the same buying power), just because the income gap is smaller?

Not if you have any real-world experience. I’m sure a few kids who’ve never had to live on their own, or guilt-ridden trust fund brats convinced that everyone being poor is better than some being really rich, but the rest of us know better.

And when people talk about The Gap Between the Rich and Poor in the US, claiming income disparity is a horrible thing that needs to be fixed, this is exactly the kind of foolish, self-destructive position they’re taking.

Socialism vs Capitalism

Who, but guilt-ridden trust fund brats, seriously would prefer for the poor to live with less, just so the rich would have FAR less?

In fact, as the above examples show, what matters can’t be the “gap”, but the actual quality of life of people in the society.

Take Communist China, for example:

- When China was much more socialist, redistributing wealth and regulating the economy with “social justice” the way the “income inequality” people want things to be, most people in the country were miserably poor…but equally so. They struggled just to subsist, living on dirt floors, literally millions dying from lack of resources that should have been readily available…but there was almost no wealth gap, at all.

- When the government realized that socialism doesn’t work, and began deregulating the economy, the gap between rich and poor exploded. It’s now hundreds, maybe thousands of times “worse” than it was…but almost everyone in China the less-regulated parts of China is better off than they were, although some are now MUCH poorer than the wealthiest.

The decline of socialism has led to a better life for many of the poor, and an increasing wealth gap, purely because some of the poor, themselves, are becoming much wealthier.

It is not income disparity that matters, but actual standards of living.

Far fewer people in China are now dying of hunger. Many of those who lived in huts with dirt floors and delivered their babies standing up in the kitchen now have modern homes and medical care…because of the very mechanisms that are making income disparity greater.

What we really need to be concerned with is quality of life, not exploiting jealousy and greed by focusing on “inequality”.

Rising Living Standards

When people claim that something forceful needs to be done about people they describe as poor, they make it sound like those people are victims of capitalism, now reduced to poverty.

The more we have, the more we want…we shouldn’t let that translate into jealousy and greed against those who have more

For example, think of people who complain that, thanks to the Roaring Twenties, one third of all Americans at the time had no electricity, indoor plumbing, access to automobiles, et cetera…but, of course, a decade earlier even fewer people had electricity, indoor plumbing, or automobiles.

In fact, just a few years earlier dirt floors were normal in the US, just like China. The very idea of what is “ill-clothed, ill-housed, and ill-fed” had shot up in standard purely a as result of the “unfettered capitalism” of the 1920s.

If not for that period of economic freedom, dirt floors and cheap, crappy clothing, and malnutrition would have still been considered normal and adequate.

Likewise, you can find people talking about protests over living standards in China, now, where they focus about the slums around the big cities, how people don’t have gas heat, live in cramped conditions, et cetera.

But, of course, just a few years ago, most of those people were peasants living in dirt-floored huts, eking out miserable lives wading in rice paddies, barely growing enough to feed themselves after the government confiscated most of their product of labor, and living on barter.

They moved to those slums because, as in Industrial Age America’s “sweat shops” it’s an improvement over what they had before. If China continues to deregulate, their living standards will continue to get better, even as their idea of how they should live increases faster, making them complain more.

One of the greatest political scientists in history, Joseph Schumpeter (with a name like Schumpeter, he had to be good) actually thought that the doom of Capitalism might simply be that it caused things to get so good that people’s idea of what they deserved would outpace how much better things were actually getting, so that they would always turn to massive government intervention to “fix” it, causing the economy to fail.

This is what happened with Herbert Hoover’s massive spending increases and regulation causing the Great Depression, and is happening now.

Some Wealthy Did NOT Earn their Money, and Need to Lose It!

But it’s true that things are unfair, today. There are many people who do not deserve the wealth they have. They did not earn it themselves, but used bailouts, “stimulus”, corporate welfare, and other coercion to steal money confiscated from others. Their corruption and inefficiency has been preserved, like a limb with gangrene, and is killing the body of the economy…like a limb with gangrene. And that needs to end, yet both dominant political parties are actually defending and increasing this economic injustice.

Instead of obsessing with the jealousy and greed of class hate, comparing who has what and trying to take away from those who produce more, we need to increase the very conditions that cause “income inequality”, to allow the poor to increase their own well-being, even if the rich increase theirs even faster…but stop actively rewarding the wealthy through government fiat, when they haven’t earned it.

We should let bad companies and people fail, therefore increasing social justice, if not income equality.

BONUS FEATURE:

Here is the original article from the Site of the Sentient, written in 1996: Income Disparity: The Gap Between the Rich and the Poor

How Student Loans Increase Your Tuition

People are complaining, as they should, about how tuition prices are shooting up far faster than inflation…in fact, how they went up even faster while the economic depression had prices stagnant or falling, nationally.

The commodity subsidized the most, is the one that's gone up the most in price. In fact, each of these is inflated in accordance to its subsidization, although energy's short-term volatility is a result of our self-destructive foreign policy.

It seems that the more the government increases grants and student loans, and gives special breaks to students or parents to help them pay for college, the more those prices shoot up and undo that benefit.

But this is not a coincidence. It’s exactly what must happen, because of those student benefits…and the more the government hands out student aid, the more the laws of Supply and Demand and of Unintended Consequences will force tuitions higher:

Subsidies

When you give away money to help people buy something in an industry, it’s technically called a “Subsidy“…and the primary function of a subsidy is to raise prices. The government, unfortunately, often does just that, on purpose, giving a subsidy in an industry because it’s been bribed by lobbyists to place the profits of the producers over the needs of the members of society (aka consumers). Farm subsidies are how it keeps milk and other staples too expensive for poor people to buy without the government’s own “help”, for example.

The way a subsidy works, of course, is that you increase the number of dollars available to buy the product, while the actual demand for that product, and therefore its supply, stays more or less the same. If people generally choose to spend a one hundred million dollars per year on apples, and they average $1 a pound, then the government offers people an extra fifty million dollars to “help” them buy apples, the average price of apples can increase to $1.50 a pound, driving up prices of pies, and giving poor people one less healthy snack they can afford. That’s a bit oversimplified, but pretty much how subsidies are used.

The way a subsidy works, of course, is that you increase the number of dollars available to buy the product, while the actual demand for that product, and therefore its supply, stays more or less the same. If people generally choose to spend a one hundred million dollars per year on apples, and they average $1 a pound, then the government offers people an extra fifty million dollars to “help” them buy apples, the average price of apples can increase to $1.50 a pound, driving up prices of pies, and giving poor people one less healthy snack they can afford. That’s a bit oversimplified, but pretty much how subsidies are used.

Sugar cane is cheaper, and better for the environment than beet sugar, but punished by a beet subsidy

People didn’t actually want beet sugar more than cane sugar, the government simply threw more money at it, so that there was more to spend, and prices rose to a new level. Why? Bribes from beet farmers.

Of course the poor benefit from the inexpensive calories of sugar, so this hike in prices caused them to go hungrier…but they don’t have lobbyists as powerful as the more corrupt and irresponsible farm organizations do.

But money poured into an industry to pay for its goods is a subsidy, with the price-boosting impact, no matter whether that’s the official intention or not:

Health Care Prices

For example, Bush’s own socialized medicine plan, Medicare Part D, threw hundreds of billions of dollars at pharmaceutical companies, for the same medicine that was already out there. Naturally, prices went up even higher, helping precipitate the “crisis” that was used to pass Obamacare…and the Obama administration now admits that, indeed, the added money from Obamacare has caused health care prices to shoot up even faster, even in the short time since it was enacted…and contrary to the claim that it had to be rushed through to reduce prices.

In fact, if you track health care prices through the past century, they shoot up each time the government imposes a program to “help” pay. The largest increase was immediately after Medicare was implemented.

College Tuitions

The Occupy Wall Street movement is correct to complain about the massive debt created by student loans...because those loans have increased tuitions, tenfold.

Therefore, it’s really no surprise that college tuitions go up each time government grants and loans increase, even when the economy is weak and driving many other prices down.

In fact, with the government’s fake “student loans” and grants now making up the majority of all money spent on tuition, it would be impossible for tuition prices to do anything but be inflated by many times what they would be if colleges had to actually compete for student money, directly.

People are, right now, complaining loudly about how tuitions are going through the roof…but Big Brotherment’s response has simply been to throw even more money at tuitions, like Obama’s recent, unconstitutional Executive Order, even though this will just increase tuitions more.

It’s as if your doctor’s proposed response to emphysema was for you to chain smoke, because the nicotine will make you feel good.

Should You “Give Back” to Your Employer?

When you buy bread for a dollar, the seller is "giving back to the community" for the dollar, by feeding you a dollar's worth of food. He is literally "feeding the hungry".

Each year, a generous social organization probably gives you tens of thousands of dollars, through your job.

You are very fortunate to be given this plentiful benefit, and should give back to the society of your bosses. Perhaps by giving them money, or volunteering to help them prosper.

“But wait” you say, “they didn’t pay me that money as charity…it wasn’t fortune! It wasn’t a windfall or luck! I earned that money! They were paying me for services I rendered to them! I owe them nothing, because it was a fair exchange!”

And you’re right, of course.

This is so obvious that my statements above were patently absurd. I couldn’t easily find a way to make them convincing, lest I drive you away by sounding like a nutcase.

And yet that’s just the sort of insanity that “progressives” advocate, these days.

That’s How They Got Rich

Certain class hate types are saying we should take even more money from the wealthy (families who make over $250K and already shoulder 90% of the Federal income tax), because “those who have benefitted most from our way of life can afford to give a bit more back“.

But most people who get rich earn their money, just like you d0. Their customers, like your employer, trade with them voluntarily, and (hopefully like your employer) believe they are getting as much or more as they are paying for. They “benefit” only exactly in proportion to how much they “give back”, already. If you earn a billion dollars in the marketplace, it means you have already given over a billion dollars in value to the people who (therefore) paid you for it.

Now it’s true that some wealthy people don’t get their money consensually. It amounts to ill-gotten loot they secured because they are the crony of some corrupt politician who hands them fat taxpayer money as pork — for example, Dick Cheney and Haliburton, or Democratic Senator Claire McCaskill’s husband. And I’m all for a special surtax on government officials, employees, and contractors and their cronies, who profit on the taxpayers’ backs instead of by contributing to society.

But if we want to attach being wealthy more with contributing to society, we need to reduce government’s influence, instead of expanding it. When government oversteps its legitimate boundaries, it ends up voilating our choices, making people rich whom we would not have chosen to pay, who did not to society for the money.

Whether with needless government contracts, bailouts, pork, or forcing you to buy from someone like a monopoly (cable and power companies) or mandate (health insurance under Obamacare, mercury-laden lightbulbs and inferior toilets), this does create wealthy people who’ve given nothing…and we need to stop it from happening.

People who earn their money have already “given back”, and don’t need to make some extra sacrifice as punishment for their success. That success shows how much they’ve already given. We need to stop the class envy greed, and focus on cutting the spending that is done on the backs of all productive Americans, freeing ourselves to succeed again.

Is the Fed Wagging the Dog?

In 2008, banks stopped lending as much money, helping drag the economy down.

They started holding it in extra reserves, instead.

This caused deflationary pressure the Federal Reserve has been “protecting” us from ever since.

We’re so lucky we have the Fed.

But why did the banks start holding excess reserves instead of lending? Were they simply scared of the economic conditions?

No, they are being PAID to do it, by the Federal Reserve.

That’s right…the Federal Reserve that is “saving” us from the banks’ refusal to lend, is paying the banks to do it.

How the Banks Work

See, banks usually take the money you deposit, and invest it. They make business loans, home loans, buy securities, and so on.

The profit they make doing that pays for the banking services they “give” you “free”.

In a sense, they are acting like a mutual fund for you…investing your money and paying you “interest” in the way of free banking.

But they don’t invest all of your money. The Federal Reserve requires them to hold back a bit “in reserve”. This is to ensure that they have money in case people want to withdraw it.

The Fed makes banks hold 10% of your checking account (and everyone else’s) in their Reserve.

The other 90%, the bank invests, driving the economy through business loans, buying securities, et cetera.

Or it did.

The Fed Wags the Dog

Up to 2008, EXCESS reserves were usually at 0. When the Fed started paying banks to hold them, this excess shot through the roof

But in 2008, the Federal Reserve started paying banks interest for anything they held in reserve.

Immediately, banks started holding EXTRA money in reserve. This is called “excess reserves”, and it had never happened in any large amount before.

Strangely, the Fed’s response to the banks doing what it is now paying them to do has been to complain that they’re doing it, and to expand its power even more, to “save” us from the lost money.

See, our capitalist economy depends on money being used to create wealth. With hundreds of billions being stuck in “reserves”, it’s not being invested to create wealth, and the economy is suffering.

In effect, the Fed is causing what Friedrich Hayek called “hording”, and identified as something that NO economic school considers healthy.

It is agreed that hording money, whether in cash or in idle balances, is deflationary in its effects. No one thinks that deflation is in itself desirable.

— Friedrich Hayek’s 1932 Letter on the Great Depression

If banks respond to free market demand by increasing their reserves, that’s good.

If the government (including the Fed, acting as its agent) forces more reserves, that’s bad.

The reason the Fed has added, or says it is adding, over a trillion dollars in “Quantitative Easing” (including the recent QE2) is to fight the deflationary effects of banks “hording” in their reserves.

This “easing” is the printing of temporary money the Fed uses to buy securities. It hopes that money will get spent without going into excess reserves…but this is dangerous, because that extra money could cause inflation after the economy recovers.

The Fed hopes to sell those securities and destroy the money it gets back, but history says it will respond almost two years too late, leaving us suffering inflation.

So the Fed is risking dramatic inflation, in order to save us from the risk of deflation it is paying the banks to create in the first place.

Many thanks to Steve Horwitz for his feedback during the writing of this article.

What Bernanke Means: QE2 Will Not Boost Money Supply

Most of the loudest critics of the Federal Reserve are aghast at Ben Bernanke’s recent interview, in which he stated that:

We’re not printing money.

The amount of currency in circulation is not changing.

The money supply is not changing in any significant way.

— Ben Bernanke, 60 Minutes Interview, December 2010

What on earth, people wonder, does he mean by that? How could he say such an obviously crazy thing?

I mean, he is spending NEW money buying up bonds and notes…everyone but Bernanke is calling this QE2 (Quantitative Easing)…and the whole point of this is to add money to the economy.

How can he say the money supply is not changing?

But he isn’t simply crazy…he means something specific, and sane (if misguided).

He means this:

Quantity Times Velocity

The real money supply is not simply the number of dollars in existence. As Nobel-laureate economist Friedrich Hayek pointed out, real money supply is really a multiplication of the amount of money, times how much the money is moving around.

(S)upply equals (Q)uantity times (V)elocity.

This chart of the movement of MZM, the best measure of money people can actually use, tells the tale of woe...velocity, and therefore REAL money supply, has fallen deeply, despite the Fed's hopeless efforts to stop it.

And right now, money velocity is as low as it’s been since the Great Depression…not surprising, since this is the first depression the US has suffered, since.

That means it’s moving very little. In fact, it’s mostly sitting around in banks, doing nothing. It is, as Bernanke implied, effectively out of circulation.

That money is as absent from the economy as if it did not exist. This is the Fed’s fault, because they started paying interest on reserves held idle right at the beginning of this depression, but that’s a separate article.

So even though we now have more Quantity than ever, it’s multiplied by an abnormally low Velocity, to the real supply is lacking.

Right now, Austrians like Hayek and socialists like Keynes would agree that our real money supply is actually at a traumatic low, because much of the quantity is sitting around, unavailable.

Let’s hear Hayek agree with Keynes, himself:

On the first issue — whether to use one’s money or whether to hoard it — there is no important difference between us. It is agreed that hording money, whether in cash or in idle balances, is deflationary in its effects. No one thinks that deflation is in itself desirable.

— Hayek in an open letter to Keynes, 1932, regarding how to respond to the Great Depression

Money, money, everywhere, but not a cent to spend.

Like the ocean in my favorite poet’s most famous poem, the money sitting around in banks is, ironically, unavailable for the real money supply.

Bernanke is trying to fix this, by temporarily buying up bonds and treasury notes, therefore bypassing the banks’ massive reserves, putting money directly in the economy.

For the moment, he is correct, that this isn’t boosting the real money supply, because so much of the money is lying salted in (virtual) bank vaults, useless.

Temporary Money

Now his critics, those who know enough monetary theory to understand about velocity the way you now do, say this doesn’t matter, because eventually the velocity will recover, and then we’ll have normal velocity times much more quantity. And that would mean inflation…there’s no way around that.

Bernanke would point out, correctly, that this is not correct, either…

See, the Fed doesn’t consider the money it is printing real. It is ephemeral, temporary money, like a Virtual Particle in physics…popped into existence for a bit, then gone.

And this is true:

When the Fed lends money to a bank overnight, the bank is required to pay it back the next day, plus interest. The same for its more recent, unhealthy bout of lending for thirty or ninety days…after that time, the bank pays the money back, with interest.

And when that money is paid back, it literally “vanishes”, into the “thin air” out of which it was created.

For now, the banks keep re-borrowing money, keeping the extra Quantity in a cycle…but when the Fed decides things are getting better, it can start making that borrowing less desirable, so banks re-borrow less, causing the Quantity of money to decline.

When it engages in Quantitative Easing (Bernanke hates that term, and calls it Credit Easing…bureaucrats love euphemisms), the same thing happens;

The Fed buys notes, adding money to the economy…but later it can SELL those notes, and destroy the money paid for them. It will probably sell them at a higher price than it bought, allowing it to actually destroy MORE money than it created, if it chooses.

So it could, in theory, keep the real money supply at a constant, stable level, allowing prices to be natural.

So Bernanke is Right, Everything Is OK?

Unfortunately…no.

The first problem is that Bernanke, and his peers, don’t understand some economic basics:

We’ve been very, very clear that we will not allow inflation to rise above two percent or less…We could raise interest rates in 15 minutes if we have to. So, there really is no problem with raising rates, tightening monetary policy, slowing the economy, reducing inflation, at the appropriate time.

Now THAT is the part that makes me gasp in horror…he thinks he can stop inflation in fifteen minutes? Doesn’t he know the fishtail effect?

Bernanke’s predecessor, Alan Greenspan, and the Nobel Laureate Chicago school economist Milton Friedman, both understood that when the Fed meddles with the economy, its effects take up to EIGHTEEN MONTHS to show up.

So the day that Bernanke decides “Oh, we’ve hit two percent inflation”, he will raise rates…and then inflation will KEEP GOING UP for at least the next eighteen months.

Eighteen months is a LONG time, in economic terms.

Fishtail Effect

It’s long enough that the Fed will become frantic, as its efforts fail to show any results…they’ll keep raising rates, selling notes and bonds, destroying money, until the economy finally seems to be turning around…weakening.

Then they will have overshot the actual mark by around 18 months. For the next 18 months the economy will KEEP getting worse, KEEP getting slower, until it enters into a recession. Because of the amount of money the Fed bubbled in during this depression, and has to suck out, it will probably be the worst recession since the Stagflation of the late seventies and resulting recessions, which were the worst in history.

It’s like when you are on an icy road, and you try to turn…the car doesn’t respond, so you turn the wheel more, and more…by the time the car responds, you’ve turned too much. You straighten the wheel happily, but the car KEEPS turning past where you wanted. So you turn in the other direction…but it keeps turning the original direction. By the time it responds, you turned too much the other way…et cetera.

This is the source of the modern “business cycle” of recessions, that have happened since the US left the Gold Standard in the 1930s. The Fed, and the rest of government, are constantly meddling with the economy, and then discovering the damage they did when it shows up years later, then reacting to that with even more damaging behavior, back and forth in an endless cycle of unintended consequences.

Now this has, up to now, been better than the “business cycle” of depressions and panics the US suffered from 1873-1933, when the US was on a fiat gold standard. But now we’re suffering a depression, despite being off the gold standard, so that’s all out the window.

What we need, of course, is for the Federal Reserve’s monopoly dollar to be replaced by a free market in money, as Friedrich Hayek proposed.

But, failing that, we need the Fed to at least go back to mostly staying out of the economy, as Alan Greenspan tried to do, instead of constantly expanding its meddling, as Bernanke has done, helping lock us into this cycle of economic devastation.

Employer’s Right to Hire…and Fire

The job you really want, right now, is being held by some lazy, incompetent fool, whose boss wants to fire him…but cannot, thanks to people like Representative Steve Cohen, Democrat of Tennessee. In fact, Cohen probably identifies with the guy stealing your job.

The job you really want, right now, is being held by some lazy, incompetent fool, whose boss wants to fire him…but cannot, thanks to people like Representative Steve Cohen, Democrat of Tennessee. In fact, Cohen probably identifies with the guy stealing your job.

This is because of the way government meddles with the hiring and firing of employees, now.

Involuntary Employers

Obviously, part of the problem is that it’s so hard to fire bad employees.

- First, ridiculous laws allow privileged groups to claim discrimination or mean treatment based on race, sex, lifestyle, or many other things, claims as vague and unrefutable as fake neck injuries…and just as indicative of the evils of lawyers and our corrupt legal system.

- What’s more, an employer is nearly as likely to be assumed guilty, by the public or the courts, as if accused of child molesting.

- The maze of what is a privileged group is so insane that the employer can’t guess WHO might turn out able to sue. Are you of a privileged lifestyle? A favored fringe religion? They’re not even allowed to ask…so EVERYONE is seen as a potential trap.

So the safe thing to do is just leave the bad employee in his job, and suffer the economic burden to the company (and therefore economy), spending even more money to work around the problem.

If only employers were free to fire bad workers, it would be easier for ALL workers to get jobs, and then prove themselves to keep them. Even if you lacked experience, an employer could feel free to take a chance on you, and see how you work out.

Forced Anonymity

Since you are banned from proving yourself on the job, you need to prove yourself before you’re hired, but when you first apply for a job, the employer knows nothing about you but some claims on a piece of paper. When he interviews you, he can ask questions that show how much you have memorized, and he can get an idea of how likable you are…but he still can’t know how you behave as an employee.

It’s to your benefit to be able to show a prospective employer what a great worker you really are, and the only really effective way to do this is through references.

But laws and our harmful legal system have made that almost impossible.

The references of bad former employees have to fear repercussions if they say anything bad about an employee…in fact, it’s considered increasingly dangerous to say anything NEUTRAL about an employee, as this has become a way of clearly not saying something good about him, to bypass the prohibition.

This means that anyone trying to call your references can’t really trust all your good reviews, so you’ve lost this tool for proving your value.

Know Your Associate

It is also illegal, effectively, to hire mainly people you know or have some social affiliation with, especially if most of whom you know are healthy, straight white males. You are required to have some artificial ratio of sex, race, sexual preference, even political viewpoint and other things, depending on how crazily PC your state is…and statistics say you won’t accidentally know exactly the right proportions of each, when thinking of what friends could fill that job opening.

This is unfortunate, because you have a better idea of the abilities of people you know, despite any biases you may have from friendship or other factors, than you could possibly know about strangers applying, especially under the current anti-reference conditions.

Another tool for finding a good employee, down the drain.

So employers are unable to screen workers well before they hire them, yet are trapped with the bad ones once they do.

Let’s Ban MORE Hiring Tools!

Not trying to prove the point by showing he's fugly, just want you to see who's attacking your right to win a job

As employers grow more desperate to find ways to pre-prove employees they are scared to hold to any standards once hired, some are resorting to running credit checks. Obviously, while it doesn’t directly show how they work, it increases the odds of knowing something about the character of the person. Not perfectly, but it gives them some chance to reasonably guess.

So you can’t prove your worth on the job, because the employer fears firing being stuck with bad workers.

You can’t prove how great you are with references, because it’s effectively illegal for them to be honest.

One of the few ways left is to allow a potential employer to run a credit check. Sure, it doesn’t show how you do a job, but there is some loose correlation between character and good credit. If your credit’s at least OK, the odds are at least somewhat better of you taking commitments seriously. And, anyway, it shows you have less incentive to steal from the company.

Having them run a credit check on you may be the thing that seals the deal.

But now, Representative Cohen and others like him want to ban even this entirely plausible hiring tool.

They literally want to make it illegal for you to give your job prospect permission to run a credit check.

Obviously, aside from how almost any intrusion in the free market causes harm, this is wrong. They want to deprive both you and the employer of one of the few remaining ways to prove you should be hired.

Why, we wonder, aren’t they instead trying to restore the other, better ways that were already banned?

If checking credit does not work well, it will die out with competition. If it works well, they have a RIGHT to use it.

Interestingly, the only employers I’ve ever had do a credit check on me were government agencies and their contractors….and this bill exempts those, as corrupt Congresscritters typically protect themselves from the bad laws they impose on us.

This bill needs to be stopped, and the current laws preventing good job matching need to be fixed.

Forget the Fed

The Federal Reserve, though bad, is a scapegoat, and ending it would neither reduce the deficit, nor rein in the printing of money

Among my political companions, “End the Fed” has been the hot, trendy thing for a while. This is mainly because Ron Paul correctly distrusts it, and has sponsored a bill to have it audited.

Now, I almost named this article Eff the Fed, because I, too, dislike it, and know it can never manage money properly…no government agency ever could. Instead of the a fiat dollar, we should have a free market in currency, like the Austrian economist Friedrich Hayek advocated . But when it comes to the fight to end it, there’s a problem.

The End the Fed crowd seems to think that getting rid of it is some magic bullet, that will accomplish all kinds of different things.

They believe it will:

- Bring back “sound money”, by imposing a gold standard.

- End the printing of new, extra money

- Restrain runaway government spending

- Prevent budget deficits

The problem is that ending it will accomplish none of those things.

In fact, it would probably make them worse.

Why?

Because the Fed isn’t what started those things happening, and none of them depend on the Fed’s existence.

Axe the IRS

In effect, fighting those things by attacking the Fed is like wanting to fight the income tax, and high taxes, by demanding “Ax the IRS”.

Obviously, we had taxes before the IRS, and we’d have taxes after it. In fact, the IRS was not created by the 16th amendment establishing the income tax, but five decades earlier, by Abraham Lincoln.

If we got rid of the IRS, we’d still have the income tax, and high taxes. Putting our time, energy, and money into attacking the IRS would be a waste of time, when we could have fought for actual tax reduction, reforming or ending the income tax, et cetera, directly.

What’s worse, the government would still want to oversee the taxes we failed to actually fix, and would probably end up using something worse than the IRS.

Well, all of this is true of the Fed, as well:

The Feds Don’t Need the Fed

The Fed and a Gold Standard are Compatible

Trade Dollars, coins minted in the US during the gold standard, in an attempt to offset a shortage of money

Ending the Fed won’t bring back a forced gold standard, because they are two unrelated issues.

We had both at the same time for decades, anyhow.

The US had a fiat gold standard from 1873, through 1934.

The Fed, of course, was established in 1913. It existed alongside the gold standard for over two decades. It helped cause the Great Depression while the US was on a gold standard. It created floods of new money in the 1920s, and drew down the money supply by 30% (which would cause any economy, at any time, to collapse) in 1929…both of these things while we were on the gold standard.

Congress Would Just Print More Money

Not only did we have a gold standard while we had the Fed, but we also printed fiat paper money when we did not have the Fed. The reason the dollar is sometimes called the Greenback, is that this was the nickname commonly used for the paper money common in the United States in the 1860s and 1870s, printed to finance the Civil War, known for its green ink .

Right now, the Federal Reserve is a bureaucratic middleman, standing between Congress and simply printing money willy-nilly. The Fed uses what are ironically called “mechanical” means, to create its electronic, funny money for banks. In other words, it has a set of rules that cause the money to be created according to some specific set of conditions, not simply all the money the government wants.

Without it, Congress will simply mandate the printing of more money, on its own, surely in accordance to its bloated, and ever-snowballing spending. They printed floods of extra money before the Fed, and would print it after.

As with the IRS, however it replaces the Fed (and, in a sense, it will have to) will probably be with a mechanism that is even worse.

The US government issued treasury notes, and created deficits in other ways, for the majority of US history where there was no Federal Reserve Bank, and would do it again without it.

Restrain the Deficits…How?

This is the silliest one, and speaks to an ignorance of how the Fed works.

The Federal Reserve certainly responds to some deficit spending by selling more treasury notes…but as with printing money and collecting taxes, this would happen whether the Fed existed or not. It simply is the middleman, again.

You might as well blame the mailman for delivering your bills.

A Big, Fat Windmill

The problem with Don Quixote attacking windmills wasn’t just that the windmills wasn’t only that the windmills weren’t actually dragons, harming people.

It was also that he was wasting the energy and time that could have gone into fighting actual bad causes.

And that’s what the End the Fed noise is doing. This energy could be spent fighting deficit spending directly, which has run rampant under Democrat and RiNO alike…or any of dozens of other issues of government abuse.

It’s Going Nowhere

Of course the last problem with tilting at windmills was that it was never going to get rid of them, anyhow.

The Federal Reserve is in no danger of being “ended”. Ron Paul is actually only sponsoring a bill to audit the Fed, which (unfortunately) will not even permanently open its records to the public, the way they need to be. It will do even less to “end” it, since government self-investigations only ever are used to create a pretense that a few new regulations have “put the problem behind us”, and things usually just get worse, thereafter.

A majority of Americans oppose the drug war. Nearly all Americans not directly on the government teat oppose its massive spending and deficits. But the mechanisms for keeping the Fed in place, on both the private and public side, are massive. Not only would getting rid of it have no more effect than axing the IRS, but it’s no more likely to happen.

How To Actually Fix Things

What we need to do, rather than waste our time tilting at the Fed, is to directly address the problems we’re using it as a whipping boy to attack, or at least focus on their actual sources.

For example:

Balance the Budget; A balanced budget amendment would stop massive deficits, rein in government spending, and eliminate much of the incentive to print money and treasury notes, under the current system.

Line-Item Veto; Giving the President the power to veto any specific detail in any spending bill would be a step in that direction, as well. This may need to be an amendment, too, in order to override corrupt Federal courts claiming that it’s somehow unconstitutional.

Pull the Pork; Rules against pork, against Congress specifying projects in detail intended just to send money to their own cronies in their district, would be devastating not only to spending (which, unfortunately, is more centered on entitlements), but also to motives to give officials legalized bribes like campaign contributions.

Or maybe something else, entirely…but, whatever is done, it needs to be done. We need to choose surmountable obstacles that will actually matter, not waste our effort and attention on some scapegoat, however undesirable it is. The Fed is a poster child for government’s destruction of finance and economy, but what we need now is real solutions, not symbolic gestures, however satisfying this one would be.

…Then Why Did They Hate Bush and McCain?

I am puzzled by those few remaining people who defend Obama adamantly…because most of them claimed to hate Bush.

I am puzzled by those few remaining people who defend Obama adamantly…because most of them claimed to hate Bush.

And yet, of course, in policy Obama is just Bush III:

Bush = Obama

- Bush had a massive “stimulus package” that used Keynesian/socialist theory to try to “help” the economy. McCain voted for it.

- Obama voted for it. Obama followed up with a second “stimulus package” of his own.

- Bush expanded the war in Iraq with a Surge, while gradually drawing things down in Afghanistan, pretending they were getting better. McCain supported him.

- Obama is expanding the war in Afghanistan with a Surge, while gradually drawing things down in Iraq, pretending they are getting better.

- Bush expanded socialized health care entitlements more than ever before in US history, with the prescription drug benefit. McCain voted for it.

- Obama is trying to expand socialized health care entitlements more than ever before in US history.

- Bush responded to each natural disaster by throwing money at it.

- Obama is responding to each natural disaster by throwing money at it.

- Bush bailed out the banks, and expanded regulations on them.

- Obama bailed out the banks, and is expanding regulations on them, using the Bush plan.

- Bush protected the unions while the car companies were trying to file bankruptcy, including a massive bailout.

- Obama protected the unions while the car companies filed bankruptcy, after including a massive bailout.

- Bush kept Guantanamo open, and “tried” people held for a year or more without trial, in secret military tribunals.

- Obama is keeping Guantanamo open, and is “trying” people held for a year or more without trial during his own administration, in secret military tribunals.

- Bush passed the USA PATRIOT Act to grant himself police-state powers in violation of the Constitution

- Obama refused to rescind, or allow to expire, the USA PATRIOT Act police state powers that violate the Constitution

McCain = Obama

McCain = Obama

- McCain proposed a trillion-dollar global warming tax/trade scheme in 2007

- Obama proposed a trillion-dollar global warming cap / trade scheme in 2009

- McCain opposed drilling in the Antarctic and off the coast of Florida in 2007

- Obama opposed drilling in the Antarctic and off the coast of Florida, in 2007 and today.

- McCain censored political speech in the name of “campaign reform” with McCain/Feingold

- Obama is fighting to censor political speech in the name of “campaign reform” against the the Supreme Court

- McCain supports amnesty for illegal aliens

- Obama supports amnesty for illegal aliens

- McCain promised to never overturn Roe v Wade

- Obama promises to never overturn Roe v Wade

- McCain wanted to undo the Bush “tax cuts”

- Obama wants to undo the Bush “tax cuts”

- McCain voted for massive new penalties and liabilities for tobacco companies

- Obama wants massive new penalties and liabilities for tobacco companies

- McCain voted for massive new penalties and liabilities for gun companies, and restrictions on gun shows

- Obama wants massive new penalties and liabilities for gun companies, and restrictions on gun shows

What on earth was their problem with Bush and McCain?

Maybe they’re just racist against white people…

Why Universal Medicare Isn’t an Option

At one time, those advocating a “public option” were trying to claim it was not a socialized health care proposal like Medicaid/Medicare.

Now they’re actually proposing that this massive socialized bureaucracy be extended to cover all Americans.

The obvious question is, with a system that requires the whole of the nation to suffer a massive tax burden in order to cover only 14% of the population, where are we going to get the huge amount of money necessary to cover 100%? Especially when that system is already underfunded, in danger of going broke in only a few years.

The obvious question is, with a system that requires the whole of the nation to suffer a massive tax burden in order to cover only 14% of the population, where are we going to get the huge amount of money necessary to cover 100%? Especially when that system is already underfunded, in danger of going broke in only a few years.

Right now, most Americans pay more to FICA than they pay in income taxes.

What happens when you increase it to cover SEVEN TIMES as many people?

Are YOU ready to pay 700% as much in taxes, to cover universal Medicare?

This socialized system only works because it involves the productive part of America paying out the nose to support a tiny fraction of the population. Making it universal would be, quite literally, saying “I know how to make a pyramid scheme work: Put EVERYONE at the top of the pyramid, at the same time!”

Why Would We Want To, Anyway?

That is aside from how bad, how harmful, Medicare already is to America, even when it only covers one seventh of Americans:

- Fraud and Theft: Medicare is already fraught with fraud…it is thought that between sixty and seventy two billion dollars are stolen from the taxpayers via Medicare fraud, each year. That’s $72,000,000,000 every year. Imagine how much the fraud would balloon if the government had to police seven times as many people. The lost money would be comparable to the recent Stimulus/Bailout spending, but it would never end.

- Too Expensive and Inefficient: Medicare is ALREADY expected to run out of money by 2017, becoming bankrupt even with its current users and tax burden. How are we going to expand it 700%?

- Abysmal quality: Consumer and doctor dissatisfaction with Medicare is only surpassed by the similarly government-mandated HMO system.

- Driving Costs: The ballooning cost of health care is consistently charted as having begun in the late sixties, right after the creation of Medicare. This system strips away consumer controls of prices…if the government took over the buying of your meals, the price of food would similarly go through the roof.

- Tax the Poor: The wealthiest segment of Americans is the oldest. Americans tend to gain more wealth as they age. Yet the poorest segment of Americans are forced to pay in full for FICA, already. In effect, the poorest are being taxed for the richest.

Next time someone suggests that we should simply extend Medicare to cover everyone, because it’s working so well, ask him where we’ll get the two billion people necessary to fund extending that this fraud-ridden, insolvent, price-ballooning system to the 86% of Americans who now fund it for the rest.

The Decline in Family is Caused by High Taxes

Blame the Parents

Statistically, parents really do spend less time with their families, these days. Because of this:

- Social conservatives, and some others who blame Hollywood, the music industry, and public schools for the decline in “family values”, condemn parents for not spending more time with their kids to offset those bad influences.

- Teachers, in a dramatic demonstration of how to serve as an irresponsible role model, prefer to blame parents, not themselves, for the decline in public education’s results. Those parents just aren’t spending the time with their offspring that they once did.

- Police like to blame parents for the trouble kids get in after school…they’re not spending enough time with them as role models.

- Technophobes blame newfangled televisions, video games, the net, and mobile phones for, well, anything cultural or behavioral…and blame the parents for not screening such entertainment, not knowing what the kids are seeing.

Family Matters

And, statistically, there’s no question that there’s some strong correlation between the amount of time parents spend with kids, or families in general spend together, and many other things, like drug use and success later in life. The more family time, the better-off the kids are.

It isn’t clear which way the causal relationship goes, but there’s certainly something happening there.

Prosperity-haters therefore blame most of society’s problems on how Greedy Materialists in America spend all day working, both parents, therefore leaving the children in the hands of day care help that is luck to keep the kids healthy and sane, much less serve as good role models and teachers.

If only they were willing to do without many of the nice things in life, like a second car and TV, they’d raise better kids.

They’re halfway correct.

The problem isn’t that people are so greedy as to wish to have decent lifestyles for themselves.

Even with your combined household income, after all government burdens, you end up keeping a fraction of what you earn

Working Man’s Burden

The actual cause of this decline in family time is taxes.

You thought the title was simply hyperbole to drag you in, didn’t you.

The typical main breadwinner in the US pays about 28% of his income in Federal taxes.

The typical second earner in the US brings in 27% of the first earner’s income, after taxes.

This means that the second parent is actually gone all day just to pay the first parent’s taxes.

And that’s only counting Federal taxes taken directly out of each earner’s check.

It doesn’t count the massive local tax burden they both pay for the public school that is failing their children, the state income taxes, and the many other tax and regulatory burdens we all shoulder outside of the direct hit on our paychecks.

But what it all adds up to is that, if not for high governmental costs, the second earner would not have to work at all, and yet the family would still have more money than it does now.

One of You Labors ONLY For Government

In fact, the second earner’s ENTIRE after-tax income is only a fraction of their household’s governmental burden.

Just cutting the tax and regulation-compliance burden in HALF would allow the second earner to stay home completely, or both earners to work far less than they currently are, and therefore spend more time with the kids…or even each other.

The greed is not on the part of the people who want to live better lives, but the government bureaucrats and the selfish people who support their massive spending (calling for expanded government, voting for politicians who bring home pork), therefore a tax burden so huge that people need to spend all day working, neglecting their families.

The death of the family is yet another problem caused by Big Brotherment, not simply bad parents.

Social conservatives, cops, teachers, and everyone else who is concerned about absent parents and family values should focus first on freeing parents to do something other than toil for the tax man.

America Already HAS Death Panels and Waiting Lists

Next time you see someone mocking the idea that America could have health care waiting lists and death panels, point out that we already do.

There is one domain of medical treatment that is mandated socialism-only, by the Federal government.

And, unsurprisingly, this system has a waiting list of over 100,000 people at a time.

You usually have to wait at least 1,000 days…nearly three years…for treatment.

In fact, you usually die before you get treated.

Why?

Big government types have heartlessly condemned thousands to death, by banning compensation to organ donors

1,000 Day Waiting List

Because it’s illegal to compensate people for donating their organs.

That’s right, you can’t pay someone for a kidney, whether they’re alive and donating one, or they just died and are a good organ donor whose family desperately needs the money.

Because of this, out of the 2,000,000 Americans who die every year, only 5,000 donate their organs. The vast majority of potential organ donors do not…but, obviously, more would if they had the hope of helping their own families deal financially with their death.

And so, with this socialized organ donation system, there is a waiting list of over one hundred thousand people, and you will probably die during the average of 1,000 days you will wait for an organ.

Imagine how many more people would sign their donor cards, put that in their living wills, et cetera, if they could hope that they could at least help support their family, if they did die.

Consider how many families, left destitute because the bread-winner unexpectedly died without life insurance, could at least have the hope of compensation because he was an organ donor. In fact, 35% of all people who did sign an organ donor card fail to donate because their family refuses consent after they died. How many might have chosen otherwise, if they could be compensated for the emotional sacrifice?

It’s even possible for people to choose to donate some organs while alive. The kidney waiting list, in some parts of the country, is ten years. That’s 3,650 days waiting for a kidney, on a dialysis machine that slowly kills you. Yet people could choose to donate a kidney any time, even when alive and healthy. Frankly, I’d never do that for money, but other people should be free to disagree with me.

As dramatized on a popular TV show, Gregory House on his way to a modern-day organ death panel, which rejects his patient, condemning her to death

Actual Death Panels

And let’s be clear: Because there is such a waiting list, there are actual panels of people who decide where each donated organ will go. They pronounce who gets them first, and who will not be allowed to have one at all, because it’d be a “waste”.

If you need an organ transplant, a panel will actually weigh how old you are, what shape you’re in, even what your lifestyle is, and then decide not only where to place you on the list, but even whether to just let you die. That’s right, if they don’t approve of how you live, they can pass you over to die.

Older people are actually passed over, because they’ve lived longer, and more “deserving” people moved ahead of them even after they’ve waited on the list.

There are already panels of people who will literally decide to let your grandmother die untreated, because she’s lived long enough.

It not only could happen in the US, it already does.

Do we really think, given the chance, that this won’t expand into every other part of health care that becomes socialized?

Criminal Transplants

It is a far greater crime when the government causes a death, because it is using supposedly legitimate authority to do so

Like Canadians and Brits sneaking to the US when their governments put them on endless waiting lists for life-threatening or painful conditions, Americans condemned to die by the socialized organ transplant system in America end up flying overseas, to obtain transplants, if they can afford to do so. Therefore the socialist prohibition actually ends up linking wealth to survival even more, not less as intended…only wealthier Americans can afford to fly a foreign country and pay for a transplant out-of-pocket. What’s more, it’s far more dangerous than an American transplant, since the US has the best surgery outcome rate of any nation on earth.

Meanwhile, avoiding questions of whether people really want to sell their organs, or are doing it for money, actually produces an even more dangerous system of commercial organ transplants, that of black market organs. There really is a question of whether an organ obtained this way was gotten from a consenting patient…and yet such a system exists only because it’s illegal to do so openly, with safe documentation.

Fix Transplants, Don’t Break Everything Else

Hope and/or pray that the US transplant system is de-socialized before you end up needing an organ, so that you won’t have to wait for years, and probably die without treatment.

And, as important, fight to keep the rest of the American health care system from ending up in the same, deadly, condition.

What If Car Insurance Were Like Health Insurance?

Insurance is supposed to be something you hope to never, ever use.

Not even once.

That’s how, for example, car insurance works. If you’re careful and lucky, you’ll “waste” money on it your whole life, and never need to make a claim. You are just pooling a risk with everyone else, and only a few of you should need to cash it in, per year.

But imagine if we all had car “insurance” that covered routine things we expect to need, like oil changes and gasoline.

Since we, and the insurance company, know we will be paying for these things regularly; our insurance cost will go up by the full amount of what we’d have paid anyway, plus the extra overhead for their bureaucratic costs and profit.

You Pay Extra for “Free” Stuff

If your car insurance now costs $800/year, and you spend another $800/year on gas/oil, for a total of $1,600/year, the price of your insurance will probably go up to well over that. For example, with a mere 10% profit margin, plus another 10% in bureaucratic costs, the extra $800 would cost you $160 on top of itself.

So you’d pay $1,760 to have “full coverage”, instead of $1,600 to have normal insurance and buy your own gasoline and oil changes.

But, worse, since we’re not actually paying for each gallon and pint out of pocket, demand for gasoline and oil changes will go up, which will increase the price. It will increase it a lot.

Think of how much people changed behavior because gas prices were high in 2008. It dramatically cut demand. People bought more economical cars, moved closer to work, didn’t drive on distant vacations as often, et cetera. And this helped cut the cost of gas back in half, because the price is set by, in part, a combination of supply and demand.

With gasoline costing “nothing”, people would feel free to buy cars that get worse gas mileage. They would feel better about living farther from work. They could go on road trips as often and far as they pleased.

So the price of gasoline would skyrocket.

But since most people would have “full coverage” insurance, they wouldn’t even notice that.

What we all would notice is the price of car insurance going through the roof.

Let’s say the price of gasoline only doubles, back to its 2008 prices. Now people are using $1,600 in gasoline per year…except they’re also driving more. Let’s say only 25% more…that’s $2,000 in gasoline. Including the profit margin and bureaucratic cost, that means the price of “full coverage” goes from $1,760 per year to $3,200 per year.

But it doesn’t stop there…the insurance company doesn’t really have the same incentive, nor power, to hold down prices that consumers do.

Oh, pundits imagine they do, because they’re big companies and all that…but they lack the power of the actual consumer: They can’t make people stop driving and getting oil changes. So the oil and gas providers are able to start raising prices, as long as they can justify it…and when money’s involved, people can justify a lot. For example, now the gas stations and quick lube joints have to pay a whole second staff just to handle the “insurance” paperwork, in order to get paid for the gasoline and oil changes we buy.

So the price of gas and oil will go up even more than supply and demand would require…which means that $3,200/year for “full coverage” car insurance is only the start. If we add a mere 10% on that for the oil/gas companies’ insurance compliance staff, plus another 10% for padding they can get away with because the insurance company can’t make its customers stop going in response to high prices, then $3,840 per year.

The Uninsured Suffer

Of course, one group will feel the pinch of gasoline and oil change prices going up:

We who are smart enough not to waste our money on “full coverage”, but buy our gasoline and oil out of pocket, saving the twenty percent overhead on the insurance. But now we’re paying insanely high prices for these things, either way.

In fact, soon nobody without “full coverage” car insurance will feel like they can afford to drive, because gasoline and oil changes are so expensive.

Inevitably, this would all balloon into a:

Car Care Crisis

Media and Liberal politicians would be demanding that government insure all Americans who are not already covered, and that they “control car care costs”, which would be expanding to cripple the economy.

They would, surely, try to nationalize automotive care…they already hate that we drive so much, they say so all the time. Instead of trying specific, reasonable things, of course, they’d demand that we put all eggs in one basket with a single, gigantic, hurried bill passed into law, all or nothing.

This, of course, will end up making things worse, as such brute-force government interventions always do.

All because people were foolish enough to start buying “insurance” for predictable, regular needs, instead of only for catastrophes they hope will never happen anyway.

Health Insurance = Car Insurance

This is what is happening, now, in the health care industry.

We are paying up to $8,000 per year for a family of five, in order to get “full coverage” that pays for our normal checkups, our doctor’s visits for colds, the flu, emergency room visits for skinned knees and sprained ankles…and then we are paying for ALL of that minor, predictable stuff, plus profit and bureaucratic costs, and increased paperwork costs from health care providers, and padding of costs handed off to insurance companies…through skyrocketing health insurance prices.

Before government stepped in, health insurance was only for rare emergencies. It cost a tiny fraction of what it does today, even considering inflation. But then government took over half of health care spending with the socialized Medicare/Medicaid programs, and forced employers to offer “full coverage” health insurance, hiding the cost you pay by deducting it from what they would offer you in the first place.

The crisis this created is exactly what we should expect to happen. The problem is simply that we’re paying middleman, for no reason whatsoever, and getting exactly what we deserve.

Why Workers Dislike Unions

We’re told by teachers, politicians, and the media that unions are the best thing ever to happen to people who work. Without them, we’d all be working 80 hour weeks, for pennies per hour, and dying by 30 from how dangerous the conditions are.

And yet, for some reason, most people not only don’t belong to unions, are not even thinking about forming unions, but wouldn’t even want their industry unionized, if they had the chance. In fact, unions are dying out. The odds are that if you don’t more or less inherit a union career because you’re locked into a Company Town situation, you will never join one.

In the 1940s, 35% of American workers belonged to trade unions. Today in the private sector, membership is less than 7%. It is even lower in states that protect your right to have a specific job without joining a union.

Why?

Because, in reality, a union takes more freedom away from a worker, than from anyone else.

Pay is Important

It’s not fun, negotiating with an employer for your compensation. Well, not unless you’re really in demand. Then it can be joyful agony, trying to decide which offer is best, and what to require you be paid…but, the rest of the time, it’s unpleasant.

But the joy and pain are both because of how completely important your pay for your work really is. Your entire lifestyle depends on that set of decisions.

Not just how much you’ll be paid, but in what form. Do you want more cash, or would you prefer more days off? Are you better off putting up with a company insurance plan, that is cheaper but less responsive and lacking in choices, or more money and save up for your own checkups? Do you want paid lunch and breaks, or more money and come home sooner?

The problem with a union is that it strips away any control you have over that life-changing question.

You don’t even get to choose when, or how, to negotiate. Union management takes all power away from you, and you have to cross your fingers, praying whatever they think is best happens to be something you can tolerate.

Even under the best circumstances, they’ll be negotiating for the lowest common denominator. What the average worker is worth, and the union will gain from getting. The problem is that in the real world, almost nobody’s average. A good compromise, famously, is one where everyone goes away equally unhappy. With a union, you don’t just have to compromise with an employer, but also with all of the other workers.

You Become a Cog

With a union, you must settle for:

What the average worker is worth…

Diluted by what benefits the union management and corporate management negotiate.

You also lose the power to be paid for your effort, quality, ideas, and unique traits.

Right to work states protect your choice to not join a union, even if there is one at the company where you work

For example, you may be willing to work extra-hard to make more money, or have more job security. You may not even need to work hard; there may be some special part of your occupation you’re particularly good at.

But most unions avoid the idea of being paid for how well you do the job, replacing it with being paid for how many years you’ve worked. What could be a worse system of payment than this?

Of course it’s bad for the customers, because quality falls by the way-side…and therefore is bad for the company, as its profit depends on that quality. But it’s also bad for you, the worker, whose efforts become meaningless…just hang on to the job for as long as you can, that’s the only way you can make more money.

Likewise, no amount of effort can protect you from being laid off during the slow or hard times, with a typical union contract. You could be the very best at your job, but if you’ve only been there a few years, you’re out the door.

The Worst Kind of Middleman

It’s bad enough that unions harm companies, consumers, and society by causing unemployment, playing insider favoritism, price increases, inefficiency, low quality, reducing non-union worker pay, and other means, plus all the above disadvantages to union members, but what do you gain, in return for this?

- The right to be forced to pay union dues, whether you find them worthwhile or not.

- The privilege to have part of that hefty fee spent to bribe government officials with policies you probably don’t actually like, and be punished if you object.

- The fortune of having some of the rest divvied up among the secretive, corrupt union management and their cronies and masters, for no apparent reason whatsoever.

- Oh, and the joy of having yet another Tyranny of the Majority government ruling over you, in the form of that union’s quasi-elected crony management.

It’s no surprise that unions actually reduce real household income.

Not a Number, but a Free Man

The reason most of us eschew labor unions like they’re a porcupine who recently attacked a skunk’s posterior, is that we really are better off as free people, than as vassals of a collective, whose real function seems to be the profit of its “leaders”.

In other words, I’d rather protect my right to earn pay based on what I’m worth, not my seniority, and not be given useless token “compensation” that sucks part of it away, like hourly coffee breaks and a dubious promise of unreasonably high, distant retirement pay, I probably won’t see, once the union bankrupts my employer.

Wouldn’t you?

Words of the Sentient:

Unionism seldom, if ever, uses such power as it has to insure better work; almost always it devotes a large part of that power to safeguarding bad work.

– H. L. Mencken

– Henry George