The History of Economic Downturns in the US

Ideas | Truth vs Myth | Your Rights | Learn from History

Climate Change Timeline | History of Economic Downturns | 8th Grade Final Exam

The Great Depression was far from the first economic downturn in US history. Here is a listing of most of the significant ones:

Depressions

During the era where commodities played a key role in controlling US currency, there tended to be economic depressions, different from recessions because they lasted longer, involved price collapses and bank failures, and were much more severe.

- 1797

- 3 Years

- Caused by gold-based deflation in Britain hitting US economy

- Price failures

The Bank of England was unable to maintain specie payments during that country’s war with France. This produced a cascade effect of currency shortages that easily crossed to the trade-based economy of the United States, where it caused massive inability to pay debt and lack of capital investment.

_____________________________________________________________ - 1807

- 6 Years

- Caused by Trade restriction, in effect protectionism, exacerbated by the disbanding of the Bank of the United States, its first central bank

- a ballooning of debt, and subsequent failures

- snowballing unemployment

- Key trigger for the War of 1812

In response to abuses by France and Great Britain, Thomas Jefferson committed the greatest mistake of his career, bringing the US economy crashing down in economic depression. His attempts to ban all foreign trade left Americans unemployed, glutted with some products and short on others. The end of the country’s first central bank produced its own disruption, right at the moment when the US would have been recovering from the worst of the embargo.

http://www.accessmylibrary.com/article-1G1-8085564/u-s-embargo-act.html

http://blogs.the-american-interest.com/wrm/2009/12/22/annals-of-disaster-the-embargo-act/_____________________________________________________________

- 1819

- Two Years

- Caused by contraction of money by the Second Bank of the US

- Credit crisis

- Deflation

- Cotton and other price failures

In 1819, the Second Bank of the United States forced a reduction in money supply, creating a credit crisis, forcing downward pricing pressures resulted in a collapse of banks, cotton prices, and prices in general.

- 1832

- Two years

- Caused by contraction of money when the National Bank was shut down by “Hard Money” advocate Andrew Jackson

- Credit crisis

- Price failures

- Massive unemployment

- Bank failures

In 1832, another contraction of credit and money causes a series of bank failures. Part of the lack of money supply was caused by Andrew Jackson shutting down the Second Bank of the United States…akin to shutting down the Fed. Ironically, a longer-term effect of shutting down this second central bank was a bad spate of inflation, as the normal banks struggling to take up the slack printed and loaned their own money, as the Constitution allowed. http://history1800s.about.com/od/thegildedage/a/financialpanics.htm http://www.thehistorybox.com/ny_city/panics/panics_article3a.htm _____________________________________________________________

- 1836

- Six years

- Caused by new mandate of silver-backed currency creating a money shortage

- Credit failure

- Record unemployment dwarfing 1832

- Bank failures

- Cotton price collapse

- money supply down 58%

In 1836, just a few years later, Jackson’s effort to force the use of “hard money” (gold and silver) produced ANOTHER contraction, causing real estate prices to plummet, as well as prices in general. Remember, suddenly declining prices are as harmful to the economy as rising prices. You don’t get something for nothing. Banks in the 1830s retained a stable ratio of gold to currency…this meant that when the economy grew, the ratio of money to the economy’s wealth plunged, creating negative price tensions that always result in economic failure. Within a year, 1837, yet another price contraction occurred, including cotton price failures, bank failures, an explosion of unemployment (normal with globally falling prices), continued real estate price instability…this gold-caused depression lasted six years, the second longest in US history. http://en.wikipedia.org/wiki/Panic_of_1837 http://www.thehistorybox.com/ny_city/panics/panics_article6a.htm _____________________________________________________________

- 1857

- Two years

- Metallic currency causes a cyclical price collapse

- Stock prices collapse

- 900 mercantile firms, in New York alone, fail

- Agricultural prices fail, triggered by a decline of demand form Europe

- Real estate prices collapse

- Significant unemployment increase

- money supply down 23%

In 1857, another cyclical wave of price/money collapse, as is inevitable under a commodity-based currency. Stock prices plunge, banks fail, prices fall…prices fall in almost every gold-based economic depression, because the economy grows but the currency cannot, creating a shortage that forces prices back down, causing rampant unemployment, bank failures, bubble-bursts of whole industries, et cetera. This lasts two years. Oh, by the way, the 1819 collapse lasted two years, too. That’s pretty much the minimum for an economic depression, whereas that would be abnormally long, for a modern recession. http://en.wikipedia.org/wiki/History_of_central_banking_in_the_United_States#1837-1862:_Free_Banking_Era http://www.thehistorybox.com/ny_city/panics/panics_article7a.htm _____________________________________________________________

- 1869

- Two years

- Gold directly causes an economic failure

- Gold prices collapse

- Stocks fail

- Rail companies collapse, paralyzing the economy

Another depression. Gold was DIRECTLY at fault for this one: Gold goes through a speculative bubble, suddenly collapsing in price, much like in 1981. This is the famous Black Friday. Gold speculators like the gold bugs you guys have to beware heeding attempted to drive the price up even higher (as they’re trying now), causing the price to spike, then collapse. As in 1981, and as will soon happen again, everyone attempting to invest in gold is pretty much bankrupted. This failure lasted two years. http://en.wikipedia.org/wiki/Black_Friday_(1869) http://www.thehistorybox.com/ny_city/panics/panics_article8a.htm _____________________________________________________________

Another depression. Gold was DIRECTLY at fault for this one: Gold goes through a speculative bubble, suddenly collapsing in price, much like in 1981. This is the famous Black Friday. Gold speculators like the gold bugs you guys have to beware heeding attempted to drive the price up even higher (as they’re trying now), causing the price to spike, then collapse. As in 1981, and as will soon happen again, everyone attempting to invest in gold is pretty much bankrupted. This failure lasted two years. http://en.wikipedia.org/wiki/Black_Friday_(1869) http://www.thehistorybox.com/ny_city/panics/panics_article8a.htm _____________________________________________________________ - 1873

- Either 5 years, or is the start of a 23 year span of economic weakness known as the Long Depression

- Caused, in large part, by a switch to the Gold Standard producing a prolonged money shortage

- Credit collapse

- Banks fail

- Insufficient money even to do normal business/trade, therefore

- 18,000 businesses fail

After only two years of economic recovery, DEFLATION itself directly causes a FIVE year depression. Credit collapses, banks fail, as do over ten thousand businesses (remember, the population of the US was a fraction of what it is, today, so that’s even worse than it sounds). This was caused, in part, by the attempt to “reign in” money supply, to synchronize it more tightly with gold. http://en.wikipedia.org/wiki/Panic_of_1873 http://en.wikipedia.org/wiki/Long_Depression _____________________________________________________________

- 1893

- 3 years (or else, it’s the final throw of the Long Depression started by gold in 1873)

- A shortage of gold creates a deflation of the US Dollar, causing the usual economic depression

- 500 banks fail

- 18% unemployment

- commodity prices collapse, including steel, grain, cotton, and timber

- 15,000 businesses fail

A return to a metal-based currency sets off another depression, the worst one until the Great Depression (which was, itself, actually a series of two depressions, the 1929 depression having gone into recovery in late 1932, and then failed under the idiotic minstrations of FDR). This depression starts with a contraction of credit, a run on banks (which is common when people expect money to be backed by metal) over 500 of which fail, the collapse of the stock market (this happened in 1869, too, forgot to mention that), then the failure of SIXTEEN THOUSAND businesses. It lasts four years…three times longer than a bad post-metal recession. But it’s also deeper and harder than the previous six year depression, making it our second worst.

http://blogs.ancestry.com/circle/?p=2824_____________________________________________________________

- 1901

Because of the worry that dollars leaving the country would create a domestic currency shortage, in the late 19th century countries often coined separate money for foreign trade, like this US Trade Dollar

- 1 year

- Declining money supply meets rising stock market

- Stock market collapse

The US strictly adopts the gold standard, producing yet another price contraction, shattering the stock market (makes our current stock decline seem like a golden age). Bank failures, economic malaise that spread globally – the US is an economic superpower already, though people don’t realize it yet, and their foolishly metal-based business cycle hurts everyone. http://en.wikipedia.org/wiki/Panic_of_1901 _____________________________________________________________

- 1907

- A shortage of money supply caused yet another disaster

- Bank failures, nationwide

- Stock failure, loss of over 50% of value

As money supply contracted, J.P. Morgan convinced various wealthy New York bankers to act as a private Federal Reserve, shoring up the banking system, and halting this economic failure…note that it worked better than any government-mandated monetary rescue before or since, including those by the Federal Reserve, FDIC, or the recent $700,000,000,000 bailout. Recognition of the dangers of an unmanaged metal currency, and the power of an influx of money to fight economic depression, resulted in an unfortunate swing to the other extreme as a “solution”: The founding of the Federal Reserve System.

http://en.wikipedia.org/wiki/Federal_Reserve http://en.wikipedia.org/wiki/Panic_of_1907 _____________________________________________________________

- 1920

- 2 years

- The Federal Reserve draws down money supply, exacerbating the economic failure caused by WWI and increasing socialist control of national economies worldwide

- Banks fail

- Stock market crashes

- Prices plummet

Government centralization of economies during WWI resulted in worldwide economic weakness, but with a new player: the Federal Reserve, founded in 1913, suddenly began tightening money supply. Because money was still based upon gold, this did not result in a modern recession in the US, but an actual economic depression. This economic failure was credited with the defeat of Woodrow Wilson’s successor, James Cox, in the 1920 election.

On the other hand, this depression was abnormally short, primarily because the Harding administration’s response was NOT more government intervention, “stimulus” programs, Keynesian economics, but simply to leave their hands off and let the correction happen.

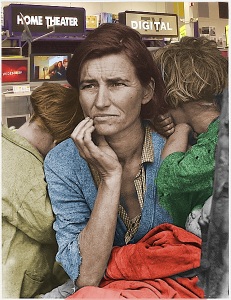

- 1929

When money deflates, people choose to just hold onto it, starving the marketplace and causing a spiral of ever more deflation

- 11 years

- The Federal Reserve draws down money supply, right when banks are needing it to serve its function of providing liquidity, causing massive failures

- Banks fail

- Stock market crashes

- Depressionary spiral

The Great Depression was not, initially, all that great. It was deep, but was of a normal length, with two quarters of recovery by the end of 1932. Unfortunately, while FDR campaigned on balancing the budget, cutting government spending, regulation, and taxes, he actually expanded all of those things, enagaging in “stimulus” activity that caused the depression to drag on another eight years. One major factor in its eventual recovery was the ending of the gold standard in 1933.

http://en.wikipedia.org/wiki/Panic_of_1819 http://www.thehistorybox.com/ny_city/panics/panics_article2a.htm

_____________________________________________________________

Recessions

In 1933, the US removed the dollar from the gold standard. Starting with its first recession in 1948, and going through 2007, the US — no longer strongly dependent upon the value of metal commodities for the value of its currency — did not suffer the severity of depressions, but instead tended to have relatively minor economic recessions when the Federal Reserve suddenly raised interest rates, causing a contraction of GDP growth.

- 1948

- 18 months

- Sharp inflation, except for:

- Decline in commodity prices

- Increased employment: 3.5% unemployment

The Federal Reserve suddenly cut interest rates, as the economic damage of WWII was being fully realized.

- 1953

- 12 months

- Moderate increase in unemployment

- GDP dropped by 6% in one quarter

- 6% unemployment

In 1952, the Federal Reserve contracted the money supply, which led to an economic recession, aggravated by the realization of the economic damage caused by the Korean War — Wars are always bad for economies, but this is usually not revealed until the war ends.

- 1957

- 8 months

- 7.5% unemployment

- 9% GDP decline

- Price inflation

The Federal Reserve again raised rates and cut money supply. Because of the economic dominance of the US, this recession spread across the whole globe. http://en.wikipedia.org/wiki/Image:Federal_Funds_Rate_(effective).svg

- 1960

- 10 months

- 6.9% unemployment

- 5.7% inflation

- Decline in goods production

Very minor downturn, on the heels of yet another sudden rate hike by the Fed. Largely confined to an increase in unemployment and inflation, like most recessions.

- 1969

- 11 months

- Moderate unemployment

- Decline in GNP

- Decline in goods production

- 1973

- 16 months

- 8.7% unemployment

- 12.2% inflation

- Dramatic decline in goods production and investment

- 11.2% interest rate

Economic upheaval caused by the end of the Breton Woods accord, the scandal and resignation of Richard Nixon, and the massive increase in oil prices caused by the OPEC embargo, produced one of the most significant recessions of the post-gold era, leading to prolonged stagflation.

- 1980

- 6 months

- 7.8% unemployment

- 12.2% inflation

- Significant investment decline

- 20% interest rate

After the end of the official recession in 1975, the economy never reached its normal economic growth, in part because of continued high oil prices, price controls unsuccessfully placed on oil that caused shortages of supply, massive increases in government regulation and spending, and price inflation caused by the high oil prices combining with the Federal Reserve’s expansion of money. By 1980, it was attempting to cut money supply again, and this era of “stagflation” climaxed in another, very short, official recession.

- 1981

- 16 months

- 10.8% unemployment

- 12.2% inflation

- Dramatic investment decline

- 21.5% interest rate

The dramatic economics changes of the Reagan administration (and the end of the Carter administration, who actually started the process, for example “deregulating” banking), albeit good in the long run, exacerbated the symptoms of stagflation in the short-term, especially a dramatic tightening by the Fed, leading to a rapid and dramatic economic downturn.

- 1991

- 8 months

- 6.1% unemployment

- 6.5% inflation

- 11.2% interest rate

Tax hikes, a spike in oil prices, significant interest rate hikes and Fed tightening, a general reversal of “Reaganomics” with the expansion of government under the Bush administration, the bailout of the Savings and Loan industry by the Federal government, preserving bad debt and inefficient businesses, the Gulf War, and other factors led to this significant, and persistent economic downturn, which was no longer officially a recession in 1992 or 1994, but was still a stagnant economy leading to two dramatic upset elections.

- 2001

- 8 months

- 6% unemployment

- 1% inflation

- 6.5% interest rate

- Prolonged stock market downturn

Ongoing Fed tightening, on the theory that economic growth is always and must be stopped, had led to a dramatic stock market decline starting in 2000. The spike in oil prices, expansion of government, and direct economic disruption caused by the 9-11 attacks exacerbated this already-building downturn, producing a relatively short “recession”, that did not actually include two quarters of official shrinkage, followed by a prolonged period of relatively slow economic growth, in which, for example, the Stock Market never actually recovered to its previous levels (which, historically, it had almost always done within two years of a decline). A decade later, the stock market still had not resumed normal rates of growth, despite occasionally having “record” gains that simply made up this or that part of the previous losses, yet never made significant new ground.

– http://inflationdata.com/inflation/Inflation_Rate/HistoricalInflation.aspx?dsInflation_currentPage=0

- 2007

We face, as was normal during the days of the gold standard, massive bank runs, a credit freeze, price failures

- ongoing

- 9.4% unemployment

- 1% deflation

- Bank failures

- Commodity price collapse

- Bank failures

While the economy never fully returned to normal economic growth, it staggered along for several years, but by 2007 the pressure of ever-increasing oil prices, years of increased government regulation, two voluntary wars, and enormous new “foreign aid” spending added up to a currency shortage that produced the first economic depression since 1938.

(this list is incomplete, but will continue to grow)

http://www.albany.edu/~renshaw/leading/ess13.html#tab13.2

http://www.bookrags.com/wiki/List_of_recessions

Climate Change Timeline | History of Economic Downturns | 8th Grade Final Exam

Trying to understand what my great grandmother was trying to teach me plus what people did to live and prosper durning hard times. I want to prepare for the next crash.

When I originally left a comment I appear to have clicked the -Notify me when new comments are added- checkbox and from now on whenever a comment is added I receive four emails with the same comment.

Perhaps there is a way you are able to remove me from that

service? Many thanks!

The Causes of the Economic Crisis for non Economists- The Austrian Approach

http://iakal.wordpress.com/2014/01/24/the-causes-of-the-economic-crisis-for-non-economists-the-austrian-school-approach/

Some truly nice and utilitarian information on this internet site, besides I believe the pattern has superb features.

Spot on with this write-up, I truly feel this website needs

a great deal more attention. I’ll probably be back again to read through more, thanks for the information!

This is confusing. =/

Lets see how much oil they sell when they cause a world wide crash…We go so does pakistan,Japan and china just to mention a few..This stuff remnds me of what a guy told me one time.He said you go into a movie theatre or concert with a flat floor and the folks behind you stretch up so they can see and the ones behind keep gettin higher and higher so they can see too…Government increases miminum wage food prices hike accordingly…11.00 for a damn can of coffee..You cant step into a grocery store now without spending 200 bucks…On top of everything else they are doin thier damndest to get gas back to 4 bucks a gallon..They keep it up and the bottom will fall out of everything then lets see what their damn gas brings!

The increase in food prices of the last several years is driven largely by oil prices, which are several times higher than they would be, thanks to our foreign policy frightening speculators.

[…] is a lot for a young country to go through and still have a 11.11% return. Here is a complete breakdown of recessions and depressions our country has taken part in. So now that you know that the stock […]

Pingback by Will you be ready for retirement? You should. | Chris Campbell's Blog | May 8, 2012 |

This is dead wrong about the effect of Keynesian Economics. Stimulus worked to carry us out of the Great Depression. After Roosevelt began his stimulus programs, the economy strengthened and unemployment fell steadily. When he cut the programs in 1937 it caused the “Roosevelt Recession,” and the economy tanked and unemployment spiked. When he refunded the programs in 1938, unemployment went back down and the economy rebounded into WWII.

> Stimulus worked to carry us out of the Great Depression.

That kind of absolute denial of the actual facts always boggles my mind:

First Hoover, then FDR, pushed stimulus from 1929-1944, and what we got was the second-longest depression, and the worst, deepest depression, in US history.

> After Roosevelt began his stimulus programs, the economy strengthened and unemployment fell steadily.

> When he cut the programs in 1937 it caused the “Roosevelt Recession,”

> and the economy tanked and unemployment spiked.

That there was a slight decline in the unemployment rate, at some point, is as irrelevant as it is when Keynesians claim the same thing, today. Whenever the government has NOT tried to “stimulate”, the economy has truly recovered within 18 months, to actually boom again. When the “stimulus” gimmick is tried, then you get the Witch-Doctor Effect, where the “treatment” makes things worse than they would have been, but the shaman proclaims “imagine how much worse things would have been without me!”

> When he refunded the programs in 1938,

> unemployment went back down and the economy rebounded into WWII.

You just demonstrated another huge fallacy, in your claim that the US “rebounded” into WWII:

WWII was devastating to the economy. It took being as sociopathic as a government bureaucrat to proclaim it a “recovery”, based on the fact that millions of unemployed were enslaved into forced military service, ergo hidden from the ivory-tower statistics.

When people across the entire economy are being forced to ration, in order to simply survive, that’s not a rebound, it’s a collapse.

And the same was true all through the New Deal. Saddling the actual, wealth-creating economy with massive tax burdens in order to fund makework jobs that are stealth welfare only cripples the economy further, even while it’s hiding unemployment. The same disaster happened in 1990s Sweden and Japan, with the same miserable results.

The New Deal and WWII brought austerity, not prosperity.

That’s what Keynesianism does.

Once the forced labor of WWII ended, the economy immediately began to show its failure in terms that even the bureaucrats couldn’t deny. It was so crippling that it prompted the first Republican Revolution, a takeover of Congress that resulted in the dismantling of much of the New Deal.

The product of that end of Keynesian stimulus was the first real prosperity and economic growth in nearly two decades, resulting in the boom of the 1950s.

Only someone who uses faith and not evidence as you have, kazvorpal, would or could believe the evidence you have offered to refute what Keynes determined. Further, you have obviously never studied the Keynesian economic analysis. Read “The House of Morgan” to see what the so called Wealth Creators/Job Creators actually did during economic downturns. They helped themselves to the spoils of a continuously deflating economy. From the 1790’s to the 1930’s there was far more wealth destruction and destitution among the lower 80% of the American population. I have a letter from my Great Grandfather to his father talking about he was starving and not finding work post WWI. He was traveling all over the west to try to find work and was asking his father to try to sell his land claim in Nebraska to get a little money for himself and my grandmother. The times were not filled with milk and honey as you would have us believe. Read a little American History not written by Glenn Beck before you spout nonsense.

The Keynesians have refuted themselves, it wouldn’t require advocates for freedom of choice to do it. They fail in 100% of the cases where they take action to “help” an economy, as in 2001 and 2008, as well as the stagflation of the 1970s, and the Great Depression itself. These were each of the longest, weakest economic downturns and recoveries specifically because they were the ones where the Keynesians interceded. But, like the voodoo shaman, they tried to take credit by claiming “sure, it was unusually bad, but if I hadn’t interceded it would have been EVEN WORSE!”.

Second, you Keynesians are the ones who clearly do not understand Keynes. They advocate for constant stimulus, where Keynes actually made it clear that if you are going to “stimulate” during the downturns, you have to do the opposite during the recovery and boom times. You need to run a surplus that completely undoes the deficit, for example. If you do not, Keynes correctly says that you will do more harm than good.

But Keynes was wrong about the very concept that government spending could ever stimulate, in the first place. The actual result of each government spending boom has been a longer downturn, because he is falling for The Broken Window Fallacy. He is failing to take into account the depressing effect of government competing with the private sector. Either it takes money away via taxes, or takes wealth away by reducing money’s value via deficit, or has a chilling effect by competing directly.

And of course bankers did bad things, during the period you mention, because they were part of a socialist, crony system, not capitalism. Banks were set up for cronies by the state, in very limited numbers and with insanely restricting rules of operation, so that there was little competition and no reward for being more efficient or responsive to consumers.

And “starving after WWI” is a great example of the impact of government intervention, not freedom of choice. US intervention in WWI was based on fraud, just like Vietnam and the conquest of Iraq. And like all wars, it was devastatingly bad for the US economy, causing an economic downturn. Fortunately, that did not last as long as other ones, specifically because the government did not intervene, which would have made things worse the way it always does.

Notice the year of depression/recession. Every president with the exception of Truman and Carter have been Republicans!

Hmmmm,comparing this information to the “annual average domestic crude prices @”inflationdata.com , it’s not to hard to see that oil prices are the main cause of our economic problems of today. In 2000 oil was $23.00

a barrel. Today it is $86 dollars a barrel. There has been an almost 400% increase in oil prices. The world uses 80-85 million barrels of oil a day. If the price of oil dropped just $10 a barrel that would translate into $850 million dollars a day being made available to be spent on other things worldwide. Doesn’t sound like much till you times that by a month($2,550,000,000). Two Billion, Five Hundred and Fifty Million dollars a month? Is that right? Wow. Times that by a year,or several years. I have heard that it cost the oil companies about $30 a barrel to get the oil to the market place. How much profit do they think that they deserve compared to the economic downfall of the rest of the people of the world? “We the people” need to get our heads out of the sand,or the clouds, or what ever and focus our attention on the real main cause of our economic problems. Check the facts for yourself. See what you come up with and spread the word. We can no longer afford to stand idly by and hope that things work out. Hope to hear from you soon.

You are correct, that without the inflated oil prices we would not have this economic crisis, despite all of the other factors. That prices have been up to 700% higher than their 2000 level (they peaked in the $140s) kept the economy too weak to weather the massive expansion of government regulation and bureaucracy under Bush.

But it’s important to note that the oil companies have zero to do with that price increase. They have no more power to change oil prices than you do if you are a seller on ebay.

Oil prices are set by speculators investing in auctions. Those speculators are betting on what they see in the future of oil’s supply and demand.

As you can see on this chart: https://butnowyouknow.files.wordpress.com/2008/11/oil-prices1.jpg

…it’s our warmongering foreign policy, starting with Bush but continuing under Obama, that has kept oil prices insanely high. People are afraid, each time we threaten an oil-producing country. Of course the effective ban on extracting the vast majority of American oil is another large factor. We are one of the top oil-having countries in the world, and the only one of those that largely bans its extraction.

[…] is why we had bigger, worse economic downturns from 1873-1934, on the gold standard, and our best overall period of growth from 1973-2001, when we left Breton […]

Knowing how the concept of a Federal Reserve Bank came to pass (a secret week-long meeting), where the process occurred (Jekyll Island, a present day resort area for the wealthy & upper middle class) and who drove the agenda (J. P. Morgan)…It sure looks like the foxes have been allowed to run the henhouse! Why do I say that? Check this out!

A number of facts indicate that a number of its current members have:

1. Intentionally recommended investments they knew would

not be beneficial for their clients.

2. Taken economic stimulus package money intended to

prevent them from failing while:

a. Cutting staffs to “cut costs”.

b. Aggressively pursuing housing foreclosures on

mortgages that, in all likelihood, should never

have been authorized in order to:

(1) Make their ledgers look good to investors.

(2) Pay back stimulus money to avoid criticism.

c. Continued to pay large bonuses to senior executives

despite the fact the company was “failing.”

d. Buying up competitors who had failed.

e. Expanded their business by:

(1) Opening new branches.

(2) Expanding the number of ATM locations.

3. When confronted about the above, showed no remorse and

attacked their critics for calling them out for what

they did.

4. Have,for years, laundered drug money from drug cartels

on a national & international scale.

In an attempt to add more fuel to the fire, here’s the following…In April 2001, I read the following in “Letters To The Editor” in the San Diego Union Tribune:

“Come on, guys! Everybody knows that business ethics in the 2000’s is passe. The only thing that matters is the

bottom line.”

From what I’ve seen since then, there are too many people out there who act on that belief. The result is a whole new standard for a lack of ethical behavior. What gets me about that is most of the major players were “idealists” while in graduate level education during the 60’s & 70’s. This is supremely disappointing…I expect better!

As a minimum,an example must be made of the perpetrators and a “mid-course correction” made in the way we live our lives. Otherwise, life as we know it will cease to exist! I have, over the years, come to believe that how we get to a destination is as important, if not more so, than where we’re heading. I hope I am not alone in this!

Read “The House of Morgan” to see how the Bankers really did manipulate, destroy, and steal people’s lives. This was in the Golden Age for Libertarians. Ann Rand ought to have lived both in Lenin’s Russia and in the US in the late 1800’s and early 1900’s to see what an ideal place America was in the post-Civil War period when Trusts evolved in Corporations which are equal to individuals. If that isn’t a contradictory concept for a rugged individualist.

Bankers certainly did manipulate, steal (via fraud), and so on…but that’s a golden age of socialism, not libertarianism.

Banking, until the 20th century, was a crony mercantilist system, not capitalism. The state would set up a very limited number of charters, creating a small, unhealthy oligopoly of banks, which were limited in the number of branches they owned. This prevented most of the developments that would have made banks more stable and honest, like bad banks failing through competition, and good ones spreading across the economy.

Rand, by the way, is a straw man that socialists use, under the pretense that her clumsy and self-defeating arguments somehow apply to everyone who believes in freedom of choice.

In reality, Rand was far more a socialist in her epistemology than a libertarian. She argued End Justifies the Means mentality like any Marxist, hated religion the same way they do, and so on. And she pulled foolish rhetorical stunts like trying to reclaim the original meaning of “selfishness”, leading socialists to simply paint her arguments as advocating for the pejorative kind.

thanks for all the info sharing…

This is a wonderful beginning research tool. I wish that info was standardized (i.e., unemployment % with each year of depression/recession you discuss), but that is a quibble.

The oral history of my family is expressed here — great- great-grandparents and great-grandparents ruined in the many 19th century downturns, grandfather’s bitterness over ‘the bankers’.

I agree about standardizing the data, but I am trying not to create the illusion of standardization, when my sources are so different for each downturn.

All too often people reformat things to make them seem standardized, when in fact behind the scenes they are not.

I’m glad to know you’ve actually heard of the stuff from your family…most people seem to think there were no economic downturns before 1929.

[…] US Depressions […]

Very nice site!

[…] History of Economic Downturns in the US […]

Kaz,

Thanks for posting all this data. It’s very informative. My only complaint is that you mention the gold standard as the reason for all the bank runs, which is misleading. Bank runs happen because of our fractional-reserve system. When fear overcomes the majority of consumers, they run to the banks because they know there aren’t 100% reserves in the vault. If we had a 100% reserve requirement, and if private companies audited the banks’ reserves, people wouldn’t worry about their deposits, and there would be no bank runs.

The problem is our fractional-reserve system, not the gold standard.

I understand how many people new to the cause of liberty and Austrian economics confuse the issues of fractional reserve banks. But, quite simply, fractional reserve banking is a natural free market service. One would have to abandon the overall conclusions of Austrian economics to prevent FRB from dominating private finance.

“If we had a 100% reserve requirement”, for example, is an advocacy of socialism. It goes against all principles of liberty, and would destroy capitalism.

A fractional reserve bank provides an explicit, essential service to its customers, and the economy. You don’t save money by hording it; you save by investing it. And a fractional reserve bank, openly and honestly, not only invests your money for you, but even guarantees your return, and provides you with instantaneous liquidity.

You might as well blame the legality of private property for the failure of real estate prices, as blame the legality of fractional reserve banking for bank runs.

In fact, the shortage of currency produces inevitable failures in many industries that depend upon a stable money supply.

Note that there were NO bank runs, from 1938-2007.

Why? Because there was no money shortage. There were occasional money surpluses, which are also bad, and the fault of the government establishing a currency monopoly…but those are not nearly as bad as a money shortage.

But in 1938, the gold standard ended. From that point on, the only real problem was the Fed’s inherent inability to manage the currency (as no monopoly can manage supply and demand competently), but until 2004 (when, in fact, the fed was behaving as gold standard advocates would have them, by failing to expand money to keep the supply steady) it never under-supplied money the way the monopoly gold standard did.

Money shortages cause commodity price failures (as with real estate prices, and prices of many other commodities, now), credit tightness, and bank runs.

Thanks, Kaz. Do you have any recommended reading on private money?

I’m new to this. Have seen the phrase “Austrian economics” but haven’t studied the subject.

When I read the phrase “100% reserve requirement” I immediately wondered whether that would that the value of my money in the bank would rise (or not), i.e., would I earn interest? I am thinking I would not, but please discuss whether the 100% reserve requirement would work much the same as banking works under the fractional system, as well as why 100% reserve requirement is socialistic.

Money deposited in a full reserve bank would never earn you interest. In fact, the bank would CHARGE you interest, for the service of keeping your money.

Banks pay interest, instead of charging it, only when they are free to openly reinvest your money, instead of locking it up in a Scrooge McDuck vault.

By definition, a 100% reserve REQUIREMENT is socialist. The emphasized word there is key. If you force people to make a single economic decision, that is socialism. People must be free to choose to deposit their money in any kind of bank they choose.

@Carolyn How does hogging up hundreds of billions of dollars of the credit market (as the government did to pay for the “stimulus bill”) expand the money supply?

@Kaz… so what do you think about the gold standard and what is your view of a healthy monetary policy?

A government-monopoly gold standard, the only type that would actually be implemented, would be even worse than what we have today, just as it was worse last time we had one.

The only healthy “monetary policy” is the same as the only healthy agricultural or internet service policy: Allow a free market of competitors offer various options, and see what evolves voluntarily.

Let banks issue currency based on commodities, or debt, or whatever. The reason fiat currency can’t work well is the same as why government farming and education always fail.

Bless you!!

very interesting. Eager to see how the upcoming expansion of the money supply will pull us out of this. Stimulus bill just passed.

February 13 (Friday), 2009.

The “stimulus” spending will not pull us out, any more than it did in 1930 or 1933. Remember that every penny the government spends is taken from the private economy, and competes with it. The private economy creates wealth, government does not, so this will simply stagnate the economy more.

Great insight. Thanks. I owned Ford stock while the US Gov was nationalizing GM, its competitor; so i felt somewhat cheated (by Keynes if you will; GM cars being the pyramides that the state should build in a recession according to Keynes). I think this was a case of government money competing with private money.

[…] About|History of Economic Downturns in the US| […]